How to Pay Back Taxes Without Stress: Your Complete Guide

Numerous Americans grapple with the challenge of settling overdue taxes. As per the most recent data from the IRS, taxpayers found themselves owing over $133 billion to the tax agency by the conclusion of the government fiscal year in the fall of 2021.

- How to Pay Back Taxes Without Stress: Your Complete Guide

- What Are Back Taxes?

- What Is Tax Relief?

- How Does Tax Relief Work?

- Do tax relief services really work?

- How long do you have to pay taxes you owe?

However, if you find yourself among the millions facing a debt to the IRS, there could be a potential solution through tax relief. Understanding the options available when struggling to meet a tax obligation is crucial. Here’s a breakdown of what you should know about the relief mechanisms accessible when confronted with difficulties in paying off a tax bill.

What Are Back Taxes?

Back taxes encompass any outstanding tax liabilities owed to the IRS or state and local tax authorities. Timely settlement of back taxes is advantageous, as the accrual of interest and penalties can contribute to the escalation of tax debt over time.

Various circumstances may lead to owing back taxes, such as:

- Inadequate tax withholding from your paycheck or other sources of income.

- Failure to remit estimated taxes when self-employed.

- Realizing unforeseen profits from the sale of investments like stocks, real estate, or cryptocurrency.

Addressing and resolving back taxes promptly is essential to mitigate the financial impact of accumulating penalties and interest.

What Is Tax Relief?

Tax relief serves as a comprehensive term encompassing government initiatives or policies designed to assist taxpayers in mitigating their tax obligations.

In its broadest context, tax relief entails various mechanisms such as tax deductions, credits, or exclusions aimed at reducing one’s overall tax liability. Additionally, special tax relief provisions are frequently implemented, particularly for individuals affected by natural disasters.

According to Alton Bell II, the founder of Bell Tax Accountants & Advisors in Chicago, “Several other forms of tax relief are available to enable individuals to settle tax debts in manageable ways.” His firm specializes in securing relief for clients grappling with the complexities of overdue taxes, providing a helping hand to those facing financial challenges in this regard.

How Does Tax Relief Work?

According to Bell, tax relief programs are contingent on the amount of tax debt owed and the taxpayer’s financial capacity.

“There is no one-size-fits-all program that suits every taxpayer’s situation,” he emphasizes. “I recommend that taxpayers visit IRS.gov to identify the program that aligns best with their specific circumstances.”

Tax relief initiatives may provide additional time for payment or assist in settling a tax debt for less than the total amount owed.

While the IRS offers various relief options, here are three worth considering if you find yourself facing back taxes:

- Short-Term Payment Plans

- An IRS short-term payment plan becomes an option if your total tax debt, including penalties and interest, is less than $100,000.

- This plan grants you a period of up to 180 days to settle your bill in full, without incurring additional fees. However, it’s essential to note that penalties and interest will continue to accumulate until the balance is fully paid.

- Application for a short-term payment plan can be made online or by contacting the IRS at 800-829-1040.

- Installment Payment Plans

- If immediate payment in full is not feasible, or within the 180-day window, you can request an installment agreement. This arrangement enables you to make monthly payments over an extended period, albeit with associated fees.

Do tax relief services really work?

In the labyrinthine world of tax troubles, the siren song of relief companies can be tempting. Promises of slashed debts and IRS appeasement dance on the horizon, but what often lies beneath is a reality of exorbitant fees and subpar service. While some companies may employ licensed professionals, they’re often drowning in a sea of cases, their expertise diluted by sheer volume. Imagine a doctor diagnosing pneumonia while juggling ten other patients – hardly a recipe for personalized care.

This is where the local tax pro shines. Think of them as the neighborhood doctor, intimately familiar with your financial quirks and offering tailored solutions. Sure, they might have a trusty nurse (think support staff) to handle paperwork, but the tax pro stays at the helm, navigating the treacherous IRS waters on your behalf. No cookie-cutter approaches here, just bespoke strategies crafted for your unique tax woes.

Think of it like choosing between a fast-food burger chain and a cozy bistro. One churns out mass-produced patties, the other whips up artisanal delights with your specific palate in mind. The choice, as always, is yours. But if you crave personalized attention and a dash of fiscal finesse, the local tax pro might just be the secret ingredient your tax troubles need.

Remember, navigating tax complexities can be daunting. Choose the guide who knows your story, not just your tax ID.

How long do you have to pay taxes you owe?

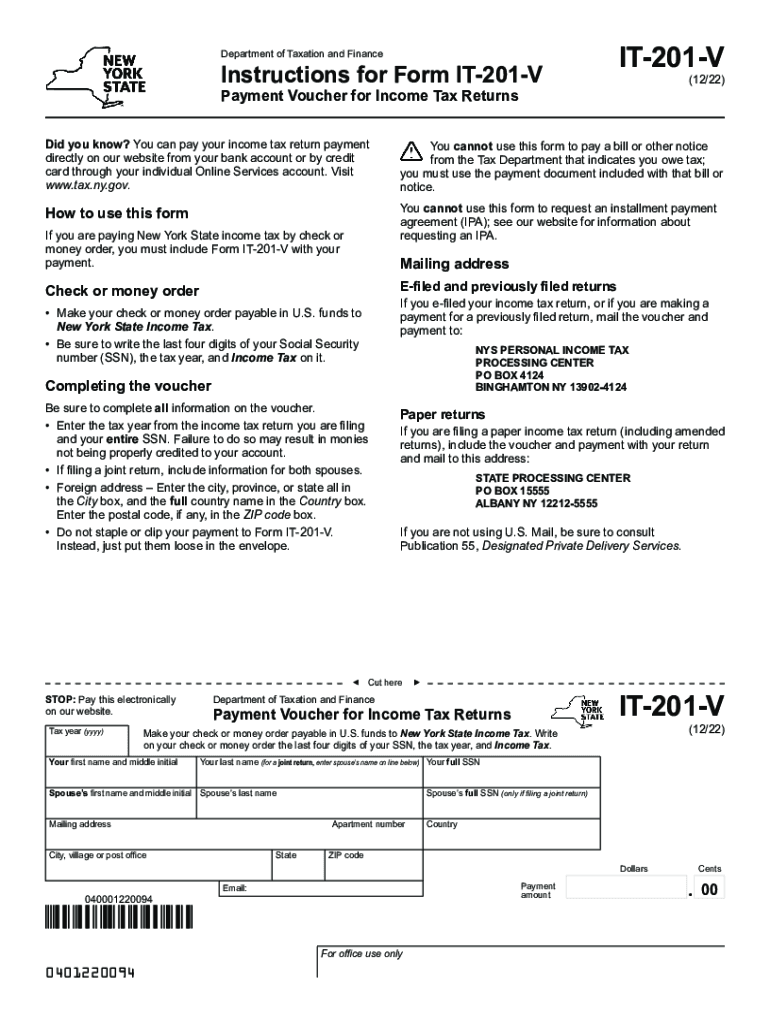

The Internal Revenue Service (IRS) prefers not to resort to aggressive measures to collect owed funds and offers a more convenient option for taxpayers – payment plans. If you find yourself in a situation where you owe taxes and are unable to make an immediate payment, exploring the possibility of qualifying for an installment plan is a prudent step. To determine eligibility, individuals owing less than $50,000 in income taxes, penalties, and interest to the IRS can consider applying for an online payment plan.

For those meeting the specified criteria, an online application for a payment agreement is available. Alternatively, if your tax debt exceeds the aforementioned limit, you will need to complete Form 9465 and send it by mail to your local IRS office. This will help assess the type of plan that aligns with your circumstances.

Upon approval, the IRS grants eligible taxpayers a maximum of 72 months to settle their tax debt in its entirety. It is crucial to note that interest and penalties will continue to accrue until the outstanding balance is fully paid. In the event of any tax refunds due in subsequent years while you are on the payment plan, the IRS reserves the right to offset those amounts against your outstanding debt. Taking advantage of these payment options can provide a structured approach to fulfilling your tax obligations while mitigating the financial strain associated with lump-sum payments.