How to Pay a Dividend: Essential Steps for Shareholder Rewards

Dividends represent the financial rewards that a company distributes to its stockholders as a way of sharing its profits. These payments are made regularly and serve as a means through which investors realize returns on their stock investments. Dividends can manifest in different forms: they may be disbursed in cash, providing investors with the option to either reinvest or withdraw for income purposes, or they can take the shape of additional shares, constituting what is commonly referred to as a stock dividend.

- How to Pay a Dividend: Essential Steps for Shareholder Rewards

- How can dividends be paid out?

- What must you do to pay a dividend?

- How much does it take to make 00 a month in dividends?

- Are dividends taxed?

It’s crucial to note that not all stocks offer dividends. For those keen on investing with a focus on dividends, the selection of dividend stocks becomes paramount. This category of stocks, as highlighted in recent news, gains significance in the current economic landscape characterized by elevated inflation levels. Investing in dividend stocks can be a strategic move for investors seeking a measure of protection amidst prevailing economic conditions.

How can dividends be paid out?

A dividend is the allocation of a portion of a company’s profits in the form of cash to a specific group of its shareholders. Usually, these dividends are either credited to a brokerage account or disbursed through a physical dividend check. While the dividend check is traditionally sent by mail to stockholders, there is also the option for direct deposit into a shareholder’s preferred account.

An alternative to receiving dividends in cash is the issuance of additional shares of stock, a practice referred to as dividend reinvestment. Many individual companies and mutual funds provide dividend reinvestment plans (DRIPs) as a common offering. These plans enable shareholders to automatically reinvest their dividends in additional shares, fostering a continuous investment and wealth-building strategy.

What must you do to pay a dividend?

Every limited company must ensure the proper documentation of the declaration of dividends. Below are the typical steps necessary before a dividend can be paid. This process can be burdensome if you are tasked with generating the documentation independently.

1. Calculate the Available Company Profit:

Determine the profit available within the company for distribution as dividends.

2. Hold a Director’s Meeting and Document the Decision:

Conduct a meeting with the directors where the decision to pay dividends is made. Produce detailed minutes that clearly outline the resolution to pay dividends.

3. Print and Retain the Minutes:

Print a copy of the minutes and ensure they are securely retained in the company’s records.

4. Produce a Dividend Voucher:

Generate a dividend voucher that provides a comprehensive breakdown of the dividend payment, including relevant details such as the amount and the names of the shareholders receiving dividends.

5. Declare the Dividend:

Formally declare the dividend by making a clear announcement or recording the decision in official documents.

Adhering to these steps is crucial for maintaining proper corporate governance and ensuring transparency in the payment of dividends. While it may seem like a detailed process, it is a fundamental aspect of managing a limited company and adhering to regulatory requirements.

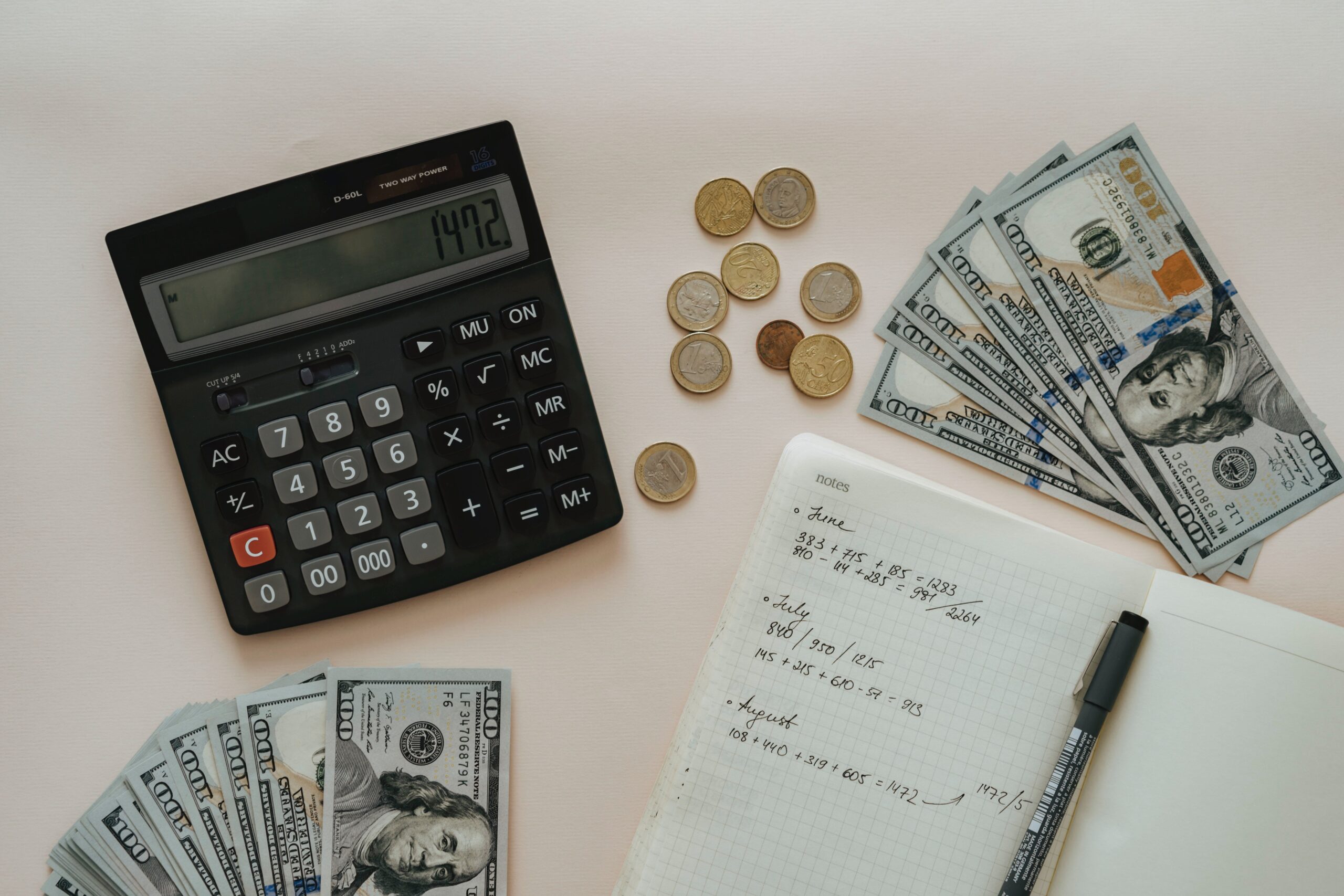

How much does it take to make $1000 a month in dividends?

To generate $1,000 per month in dividends, it’s essential to approach the goal on an annual basis, aiming for a total of $12,000 per year. Start by identifying dividend-paying stocks with a consistent history of regular payments. Focus on companies with reliable track records, as past consistency often indicates future reliability.

When evaluating stocks, consider the balance between strong and sustainable yields. While a higher yield may seem attractive, it’s crucial to ensure that it’s not abnormally high, which could signal potential issues such as a recent stock price drop or poor financial management by the company.

For a reliable income stream, begin with larger, established companies, especially those listed on the S&P 500, known for regular and substantial dividend payments. Additionally, explore dividend-oriented exchange-traded funds (ETFs), which can provide diversified exposure to dividend-paying stocks.

Given that most investors may not have the initial capital to achieve a $1,000 monthly dividend goal, consider reinvesting dividends over time. This strategy allows for compound returns, where the reinvested dividends contribute to generating additional income. While reaching the target may require patience and consistent investing, the combination of a prudent yield approach and reinvestment can lead to success over time.

Are dividends taxed?

As the IRS categorizes dividends as income, taxes are typically owed on them. Even if you choose to reinvest all dividends into the same company or fund, taxes are still applicable, as the dividends technically pass through your hands. The specific tax rate for dividends depends on whether they are classified as non-qualified or qualified.

Non-qualified dividends are taxed at regular income tax rates and brackets set by the federal government. On the other hand, qualified dividends enjoy lower tax rates aligned with capital gains tax rates. However, exceptions exist.

For a clearer understanding of the tax implications of dividends and how they may affect you, consulting a financial advisor is recommended. A financial advisor can analyze the impact of investment decisions in the context of your overall financial situation. Utilize our free financial advisor matching tool to explore suitable options in your area.