How to Calculate the 13th Salary: The Ultimate Guide

Have you ever wondered about that extra paycheck some lucky folks receive at the end of the year? If you’re scratching your head wondering what a 13th salary is or how to calculate it, you’re in the right place. In this comprehensive guide, we’ll dive deep into the world of 13th-month pay, unraveling its mysteries and helping you master the art of calculating the 13th salary. Whether you’re an employer looking to reward your hardworking team or an employee curious about your potential bonus, this article has got you covered. So, grab a cup of coffee, sit back, and let’s embark on this financial journey together!

- How to Calculate the 13th Salary: The Ultimate Guide

- Understanding the 13th Salary: What Is It and Why Does It Matter?

- The Origins of the 13th Salary

- Who's Eligible for the 13th Salary?

- The Basics of Calculating the 13th Salary

- What Constitutes "Basic Salary"?

- The Importance of the Work Period

- Advanced Considerations in 13th Salary Calculations

- Handling Salary Changes

- Dealing with Leaves and Absences

- The Role of Overtime and Commissions

- Legal and Regulatory Aspects of 13th Salary

- Mandatory vs. Voluntary 13th Salary

- Tax Implications

- Timing of Payment

- Best Practices for Employers in Calculating and Paying 13th Salary

- Clear Communication

- Accurate Record-Keeping

- Use of Payroll Software

- Regular Review and Audits

- Tips for Employees: Understanding Your 13th Salary

- Know Your Rights

- Keep Your Own Records

- Ask Questions

- Plan Ahead

- The Future of 13th Salary: Trends and Predictions

- Global Adoption

- Flexibility in Payment

- Integration with Total Rewards

- Technology and Automation

- Sources:

- FAQs

Understanding the 13th Salary: What Is It and Why Does It Matter?

Before we dive into the nitty-gritty of calculating the 13th salary, let’s take a moment to understand what it actually is. The 13th salary, also known as the 13th-month pay or Christmas bonus in some countries, is an additional month’s worth of salary paid to employees, typically at the end of the year. It’s like a financial pat on the back for a year’s worth of hard work and dedication.

But why does it matter? Well, for employees, it’s a welcome boost to their income, often helping with holiday expenses or savings goals. For employers, it’s a powerful tool for motivation and retention, showing appreciation for their workforce. In some countries, it’s even mandated by law, making it an essential part of the compensation package.

Now, you might be thinking, “That sounds great, but how do I actually calculate it?” Don’t worry, we’re getting there! But first, let’s look at where this practice comes from and who’s eligible for it.

The Origins of the 13th Salary

The concept of the 13th salary has its roots in various cultures and traditions around the world. In some countries, it evolved from the practice of giving Christmas bonuses, while in others, it was introduced as a way to protect workers’ purchasing power in times of high inflation. Today, it’s a standard practice in many countries, particularly in Latin America, parts of Europe, and some Asian nations.

Who’s Eligible for the 13th Salary?

Eligibility for the 13th salary varies depending on local laws and company policies. In countries where it’s mandated, most full-time employees are typically eligible. However, the specifics can differ. For example:

- In some places, part-time workers may be eligible for a pro-rated amount

- There might be a minimum employment period requirement (e.g., working for at least one month in the year)

- Some countries exclude certain types of workers or high-earning executives

It’s always best to check your local labor laws or company policies to understand your specific situation.

The Basics of Calculating the 13th Salary

Now that we’ve laid the groundwork, let’s roll up our sleeves and get into the meat of calculating the 13th salary. While the exact calculation can vary depending on local regulations and company policies, there’s a basic formula that’s commonly used:

13th Salary = (Total Basic Salary Earned in a Year) ÷ 12

Sounds simple enough, right? But as with many things in life, the devil is in the details. Let’s break this down further:

What Constitutes “Basic Salary”?

When we talk about basic salary, we’re usually referring to the fixed amount an employee receives regularly, excluding any additional benefits or bonuses. However, the exact definition can vary. In some cases, it might include:

- Regular wages

- Fixed allowances

- Commissions (in some cases)

It typically doesn’t include overtime pay, variable bonuses, or non-monetary benefits. But again, this can vary based on local laws or company policies.

The Importance of the Work Period

Another crucial factor in calculating the 13th salary is the work period. If an employee has worked for the full year, the calculation is straightforward. But what if they’ve only worked for part of the year? In these cases, a pro-rata calculation is usually used:

Pro-rata 13th Salary = (Total Basic Salary Earned) ÷ (12 x Number of Months Worked)

For example, if an employee started work in July and earned a total basic salary of $30,000 by December, their pro-rata 13th salary would be:

$30,000 ÷ (12 x 6) = $2,500

Remember, some companies might have different policies for new employees or those who’ve left mid-year, so it’s always worth checking the specific rules that apply to you.

Advanced Considerations in 13th Salary Calculations

While the basic formula for calculating the 13th salary is a good starting point, real-world scenarios often require a more nuanced approach. Let’s explore some of the complexities you might encounter:

Handling Salary Changes

What happens if an employee’s salary changes during the year? This is a common scenario, especially for those who receive promotions or performance-based raises. In these cases, you have a few options:

- Average Salary Method: Calculate the average monthly salary for the year and use that as the basis for the 13th month pay.

- Current Salary Method: Use the employee’s salary at the time of the 13th month pay calculation.

- Weighted Average Method: Calculate a weighted average based on the time spent at each salary level.

The choice often depends on company policy or local regulations. Let’s look at an example using the weighted average method:

| Period | Monthly Salary | Months | Total |

|---|---|---|---|

| Jan – Jun | $3,000 | 6 | $18,000 |

| Jul – Dec | $3,500 | 6 | $21,000 |

Total Salary for the Year: $39,000

Weighted Average Monthly Salary: $39,000 ÷ 12 = $3,250

13th Month Pay: $3,250

Dealing with Leaves and Absences

Another wrinkle in calculating the 13th salary comes from handling various types of leaves and absences. The treatment can vary depending on the nature of the leave:

- Paid Leave: Usually counted as part of the working period and included in the calculation.

- Unpaid Leave: Often excluded from the calculation, reducing the total basic salary and possibly the number of months worked.

- Maternity/Paternity Leave: Treatment varies by country and company policy. Some include it fully, others partially.

It’s crucial to have a clear policy on how different types of leaves affect the 13th salary calculation to ensure fairness and compliance with local labor laws.

The Role of Overtime and Commissions

The treatment of overtime pay and commissions in 13th salary calculations can be a bit of a grey area. Some countries or companies include them, while others don’t. If they are included, you might use approaches like:

- Including average monthly overtime or commissions

- Including a percentage of total overtime or commissions earned

- Including only guaranteed or regular commissions

The key is to have a consistent policy that’s clearly communicated to all employees.

Legal and Regulatory Aspects of 13th Salary

When it comes to calculating the 13th salary, it’s not just about math – there’s also a legal side to consider. The regulations surrounding 13th-month pay can vary significantly from one country to another, and even between different regions within a country. Let’s explore some key legal aspects:

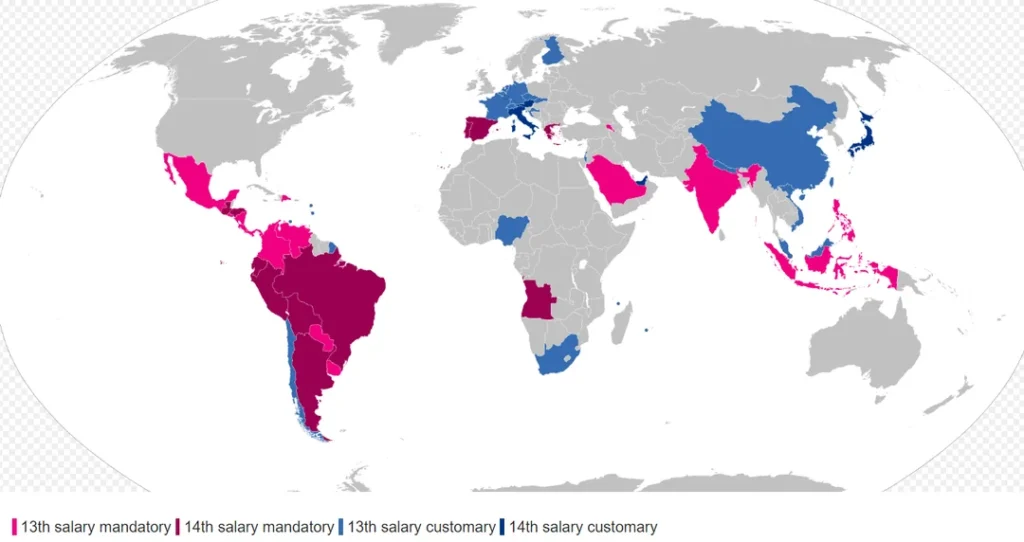

Mandatory vs. Voluntary 13th Salary

In some countries, the 13th salary is mandated by law. For example:

- In Brazil, the 13th salary (known as “décimo terceiro salário”) is a legal requirement.

- In the Philippines, all rank-and-file employees are entitled to 13th-month pay by law.

- In Italy, most collective bargaining agreements include provisions for a 13th (and sometimes even a 14th) month salary.

In other countries, it’s a voluntary benefit offered by companies. For instance, in the United States, year-end bonuses (which can be similar to a 13th salary) are generally at the discretion of the employer.

Tax Implications

The tax treatment of the 13th salary can also vary. In some places, it’s taxed just like regular income. In others, it might enjoy special tax treatment. For example:

- In the Philippines, the 13th-month pay is tax-exempt up to a certain amount.

- In Brazil, the 13th salary is subject to income tax, but the tax is often calculated separately from regular monthly income.

It’s crucial for both employers and employees to understand the tax implications to avoid any surprises come tax season.

Timing of Payment

The timing of the 13th salary payment is often regulated as well. Common approaches include:

- Paying the full amount in December

- Splitting the payment into two installments (e.g., half in July and half in December)

- Paying upon termination of employment for those leaving mid-year

Always check local regulations to ensure compliance with payment timing requirements.

Best Practices for Employers in Calculating and Paying 13th Salary

If you’re an employer responsible for calculating the 13th salary for your team, here are some best practices to keep in mind:

Clear Communication

Transparency is key when it comes to 13th salary calculations. Make sure your employees understand:

- How the 13th salary is calculated

- What components of their compensation are included

- When they can expect to receive the payment

Consider creating a clear, written policy that outlines all these details.

Accurate Record-Keeping

Maintaining accurate payroll records throughout the year is crucial for correct 13th salary calculations. This includes tracking:

- Basic salary payments

- Any salary changes

- Leaves and absences

- Overtime and commissions (if applicable)

Good record-keeping not only ensures accurate calculations but also helps in case of any disputes or audits.

Use of Payroll Software

Invest in good payroll software that can handle 13th salary calculations. This can help:

- Reduce errors in calculations

- Save time and effort

- Ensure consistency in application of policies

- Generate reports for analysis and compliance

Many modern payroll systems have built-in features for handling 13th-month pay calculations, making the process much smoother.

Regular Review and Audits

Regularly review your 13th salary calculation processes to ensure they remain accurate and compliant. Consider:

- Annual audits of 13th salary calculations

- Staying updated on any changes in local labor laws

- Seeking feedback from employees on the clarity of your policies

This proactive approach can help catch any issues early and maintain trust with your employees.

Tips for Employees: Understanding Your 13th Salary

If you’re an employee in a company or country that offers a 13th salary, here are some tips to help you understand and verify your 13th salary calculation:

Know Your Rights

Familiarize yourself with local labor laws regarding 13th-month pay. Understanding your rights can help you ensure you’re receiving what you’re entitled to.

Keep Your Own Records

While your employer should be keeping accurate records, it doesn’t hurt to maintain your own. Keep track of:

- Your monthly basic salary

- Any salary changes during the year

- Periods of leave or absence

This information can be useful if you want to double-check your 13th salary calculation.

Ask Questions

Don’t hesitate to ask your HR department or payroll team for clarification on how your 13th salary is calculated. Understanding the process can help you plan your finances better and spot any potential errors.

Plan Ahead

Knowing that you’ll receive a 13th salary can be a great opportunity for financial planning. Consider using this extra pay for:

- Paying off debts

- Boosting your savings or emergency fund

- Investing in your future

- Treating yourself (responsibly, of course!)

Remember, while the 13th salary can be a nice boost, it’s best not to rely on it for essential expenses.

The Future of 13th Salary: Trends and Predictions

As we wrap up our deep dive into calculating the 13th salary, let’s take a moment to look ahead. What does the future hold for this practice?

Global Adoption

While the 13th salary is already common in many parts of the world, we might see increased adoption in other countries as companies compete for talent on a global scale.

Flexibility in Payment

Some companies are exploring more flexible approaches to 13th salary payments, such as:

- Allowing employees to choose when they receive the payment

- Offering the option to receive the 13th salary in installments throughout the year

- Providing the choice between a 13th salary and other benefits

Integration with Total Rewards

We might see the 13th salary becoming more integrated with broader “total rewards” packages, which consider all aspects of compensation and benefits holistically.

Technology and Automation

Advancements in payroll technology will likely make calculating the 13th salary even more accurate and effortless, potentially allowing for real-time calculations and projections.

As we look to the future, one thing is clear: understanding how to calculate and manage 13th salary payments will remain an important skill for both employers and employees in many parts of the world.

To dive deeper into the world of salary calculations and compensation, check out this informative video:

Sources:

FAQs

Q: Is the 13th salary the same as a Christmas bonus?

A: While sometimes used interchangeably, they’re not always the same. A 13th salary is typically a full month’s pay, while a Christmas bonus can vary in amount and isn’t always guaranteed.

Q: Do part-time workers get a 13th salary?

A: This depends on local laws and company policies. In some places, part-time workers are eligible for a pro-rated 13th salary based on their working hours.

Q: Can a company decide not to pay a 13th salary if it’s having financial difficulties?

A: If the 13th salary is mandated by law, companies generally must pay it regardless of their financial situation. If it’s a voluntary benefit, the company may have more flexibility, but should clearly communicate any changes to employees.

Q: How is the 13th salary taxed?

A: Taxation of the 13th salary varies by country. In some places, it’s taxed like regular income, while in others it may enjoy special tax treatment or exemptions up to certain amounts.

Q: Can the 13th salary be paid in installments?

A: Yes, in many places the 13th salary can be paid in installments. A common practice is to pay half in the middle of the year and the other half at the end of the year, but this can vary based on local laws and company policies.